The ‘Corporate Transparency and Register Reform’ white paper has recently been published by the UK Government. Following various consultations with stakeholders since 2019, there is a clear need for reform to combat abuse of the company framework in the UK.

Companies House offer an open, flexible company registration system. The electronic, transparent company register is widely regarded as one of many strengths of the corporate framework in the UK and this promotes confidence in the UK business environment. Entrepreneurship is encouraged by the limited liability of UK companies. The price of limited liability is transparency. Companies House make information about directors, shareholders and the financial position of UK limited companies accessible to the public.

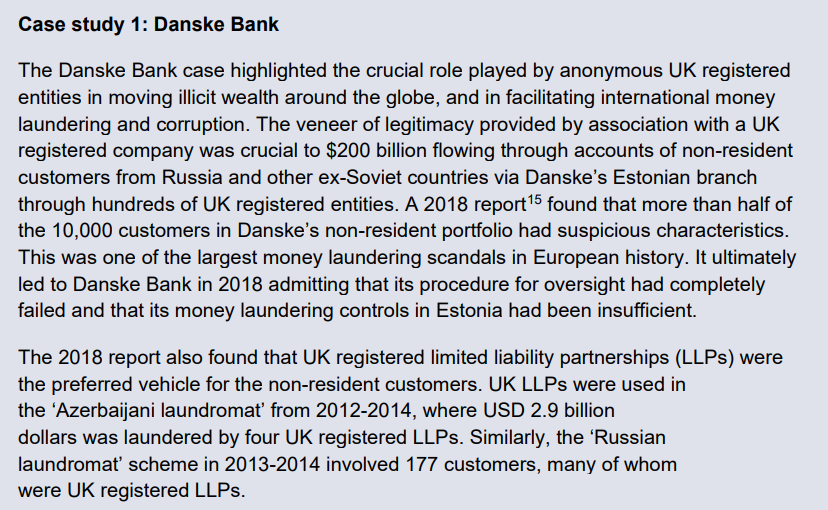

However, it is no secret that this system has been abused by bad actors who set up complex structures with false information for the purpose of money laundering and economic crime. In recent years, it has been reported that thousands of corporate entities registered in the UK have been found to be being used to facilitate major international money laundering schemes. This is demonstrated by the case study below.

This is a clear threat to the UK’s reputation as a world leading place to do business and the proposals outlined in these reforms address this. Some of the key changes are highlighted below.

Identity checks

Under the current legislation, accountants, solicitors and company formation agents like ourselves, collectively known as Trust or Company Service Providers (TCSPs), are required to carry out due diligence checks on the identities of directors or shareholders for any new company they register. TSCPs are supervised by HMRC and must adhere to anti money laundering regulations in the UK.

Companies House do not verify information and identity of directors and shareholders to this extent at present. Their current function is to incorporate and dissolve companies, to record documents filed with them and to make this information available to the public. Documents filed with them are generally accepted in good faith and they do not currently have the statutory power or capability to verify the accuracy of information submitted to them.

In order to make information on the Company Register more reliable, the proposed reforms include a change to the statutory powers available to Companies House and to how they identify a director or PSC. A director or PSC registering a new company or filing documents on behalf of the company will be linked to an authorised identification document so that Companies House can determine if a person submitting information to them are who they say they are.

Corporate directors

At present, a UK company can have a corporate entity appointed as a director, shareholder or PSC. Whilst it is a positive that Companies House promote transparency by making this information publically accessible, this is somewhat undermined by the fact that a non-UK corporate entity can be appointed as a director, shareholder or PSC.

A UK company can have a non-UK corporate entity from a country that does not have a transparent company register appointed in one of these positions. This creates the opportunity for anonymity which, in turn leaves room for the UK company framework to be abused. A UK company can be registered with a complex structure where it can be very difficult, if not impossible, to accurately identify who is ultimately behind this company.

The proposed reform addresses this with the provision that, once the changes are implemented, a corporate entity will only be permitted to be appointed as a director of a UK Limited Company if it is a UK registered corporate entity. Different rules will apply to LLPs and LPs and these are yet to be determined.

Financial information

UK limited companies have a legal obligation to file accounts with Companies House each year. This information is publicly accessible and promotes trust in the UK economy. Investors in UK markets can assess the financial position of UK companies. It is therefore imperative that financial information is current and accurate in order to maintain the attractiveness and integrity of the UK economy.

As referenced previously, Companies House are limited by their statutory powers to verify financial information submitted at present. The reforms propose new powers for the Registrar, including the power to query and reject information submitted. Company accounts will also need to be filed in ‘Inline Extensible Business Reporting Language (iXBRL) which is the industry standard in countries such as USA, China and Japan. This should enable Companies House to quickly check and validate the information submitted.

Companies involved in money laundering or economic crime can file inaccurate accounts at present and this proposal should mitigate the risk of the UK company framework being abused in this way.

Summary

There are many other proposed reforms to corporate transparency and these changes are a welcome step in the right direction. Individuals or companies who abuse this system should be identifiable and accountable. The changes should make forming a company with inaccurate information for the purpose of money laundering a lot more difficult and should also discourage those who wish to hide the ownership of a company via complex or opaque corporate structures.

Any acceleration of these changes would also be very welcome and there is a clear and relevant need for these changes considering the current geopolitical situation. The UK are one of many countries imposing economic sanctions on Russia following their declaration of war on Ukraine. It is no secret that a great deal of wealth from former soviet countries is being hidden and moved within the UK via abuse of the current corporate framework of this country.